The overall forecast for the medical device industry is overwhelmingly positive, with an expected global revenue of $595 billion in 2024. The healthcare sectors driving the most growth in the medical device market are:

- Cardiovascular

- Orthopedic

- Neurovascular

- Urological

- Diabetes

The growing prevalence of chronic disorders—including cancer, diabetes, and infectious diseases—is driving an increase in diagnostics, testing, and monitoring that not only calls for more medical devices but also greater product innovation. Here are the top six medical device industry trends of 2024.

Trend #1: A Rise in Digital Therapeutics and At-Home Diagnostics

The popularity of digital therapeutics (software-based medical devices) skyrocketed during the pandemic and shows no signs of slowing down. These devices are typically AI-based and used by clinicians to virtually treat, manage, and prevent a wide array of diseases and disorders. The U.S. market for digital therapeutics is anticipated to have a compound annual growth rate of 29.8% between 2020 and 2025.

Like digital therapeutics, at-home diagnostics empower patients to take their health into their own hands, but the latter are designed specifically to diagnose potential conditions or diseases. Many people have become accustomed to at-home testing for the COVID-19 virus, and there are opportunities for at-home diagnostics beyond COVID testing. We will likely see increased proliferation and adoption of these self-tests to assess a variety of health conditions. This trend is directly related to the second trend we anticipate for 2024.

The growing prevalence of chronic disorders is driving an increase in diagnostics, testing, and monitoring that not only calls for more medical devices, but also greater product innovation.

Trend #2: Increased Adoption of Biometric Devices and Wearables

Advances in circuit miniaturization have enabled companies in the medical device industry to develop a wider variety of wearables and biometric devices, allowing them to take advantage of the growing demand for remote patient monitoring (RPM). RPM technologies track patients’ vital signs and deliver data in real time. This fosters better healthcare delivery through non-invasive diagnosis, treatment, and accurate prognoses in medical emergencies. The recent uptick in alternative data investments, like real-world data, provides healthcare companies with more information on human biometrics, further accelerating growth in the wearable space. The healthcare areas currently leading wearable adoption are audiology, health science, kinesiology, nursing, occupational therapy, pharmacy, and physical therapy.

The increasing popularity of biometric and wearable devices will see more players in the medical device industry procuring electronics manufacturing services (EMS) with engineering teams. After all, as manufacturing processes become more complex and we move into the era of the smart factory, in-house engineering teams will give EMS providers a competitive advantage by enabling them to improve production velocity and quality.

Trend #3: Greater Focus on Sustainability and ESG Goals

The healthcare industry generates over 4.6 percent of greenhouse gas emissions globally. The medical device industry is a top contributor within that space due to supply chain emissions, single-use devices, and consumables. So, it’s no surprise that regulators and investors are calling for medical device manufacturers to reduce the environmental impact of their products and prioritize sustainable practices throughout their product development and manufacturing processes.

The medical device industry is increasingly embracing environmental, social, and governance (ESG) priorities and implementing comprehensive sustainability initiatives to move toward carbon neutrality. When EY surveyed life sciences CEOs, nearly 80 percent planned to adjust their global operations or supply chains to address sustainability concerns. Around 55 percent reported that M&A will be a key strategic play to gain ESG expertise and boost sustainability.

To meet their ESG goals, more medical device manufacturers are adopting design for sustainability (DFS) best practices. DFS considers a product’s environmental, economic, and social impacts throughout its entire lifecycle, and promotes the development of devices that can be easily recycled. This is especially important as the reprocessing of medical devices has been shown to greatly minimize medical waste—reducing hospital costs by up to 50 percent and cutting ozone depletion by almost 90 percent.

Trend #4: Generative AI for Medical Device Industry 4.0

No trends list for 2024 can exclude AI—ours sure doesn’t. Like so many other industries during the global pandemic, the medical device industry was deeply impacted by supply chain challenges. Since then, the sector has been pursuing ways to streamline factory operations and manufacturing processes. Generative AI, which enables machines to autonomously create and innovate, is fast emerging as a preferred tool for increasing efficiency.

Used in combination with digital twins (virtual replicas of physical assets or systems), generative AI is allowing manufacturers to quickly analyze vast amounts of data and create highly accurate models of their supply chain processes, manufacturing constraints, and factory operations. These simulations are powerful for mitigating risk, predicting maintenance needs, and optimizing design, manufacturing, and distribution processes.

Trend #5: Increased Medical Device Industry Cybersecurity Controls

The explosion of smart, connected medical devices has prompted the medical device industry to adopt the multi-layered cybersecurity best practices that are common in other industries. And with the passage of the Consolidated Appropriations Act of 2023, the FDA is now required by law to include cybersecurity in its review of medical devices that contain software and connect to the internet, such as heart defibrillators and continuous glucose monitors (CGMs).

This federal oversight of medical device security is considered critical for the safety of patients and the protection of their personal information. And to deliver on its new mandate, the FDA is now required to update its cybersecurity guidance every two years, which means device manufacturers will have to keep up to ensure premarket submissions are acceptable.

Guiding principles found in the FDA’s cybersecurity guidance to manufacturers include the following:

- Cybersecurity is part of device safety and quality system regulations (QSR). This may be satisfied through a Secure Product Development Framework (SPDF) that encompasses all aspects of a product’s lifecycle, including development, release, support, and decommission.

- The FDA will assess the adequacy of a device’s security based on the device’s ability to provide and implement the following security objectives throughout the system architecture:

- Authenticity, which includes integrity

- Authorization

- Availability

- Confidentiality

- Secure and timely updates and patches

- Device users must have access to information pertaining to the device’s cybersecurity controls, potential risks, and other relevant information for maximum transparency.

- Device cybersecurity design and documentation are expected to be commensurate with its risk. For example, if a thermometer is used in a safety-critical control loop, or is connected to networks or other devices, then the cybersecurity risks for the device are greater, and submissions should include more substantial design controls and documentation.

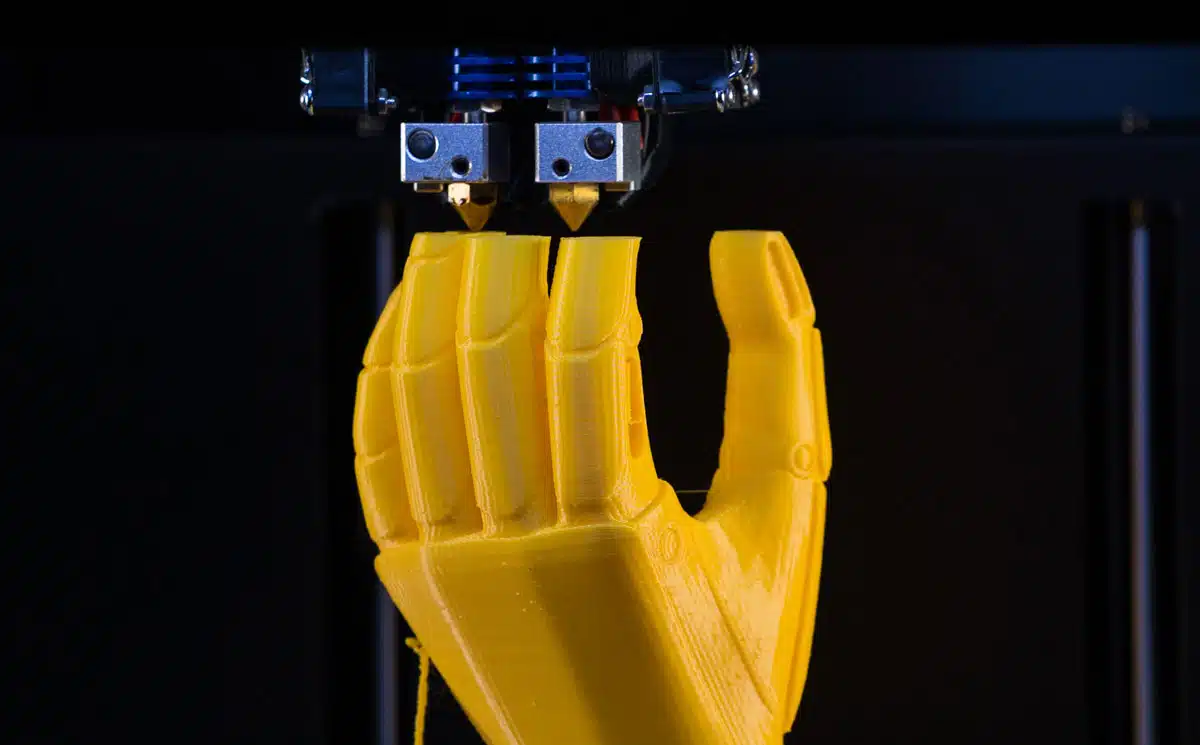

Trend #6: 3D Printing Improves Medical Device Design

Technological advancements in 3D printing, increased investment, and growing use cases for 3D printing in the medical device industry are driving the rapid growth of this technology. One recent analysis found that the market for 3D printed medical devices will reach $6.9 billion by 2028. Medical devices that can be 3D printed include external wearable devices, clinical study devices, implants, and even tissues.

For medical device manufacturers, 3D printing is an opportunity to produce more personalized products, like prosthetics. More specifically, medical device companies can use 3D printing to integrate anatomical and pathological structures in the design of their products, enabling a customized fit. 3D printing is also more cost-effective for manufacturing. 3D printing individual parts on site can reduce energy consumption from manufacturing, storing, and shipping parts by as much as 64 percent, according to researchers at Michigan Technology University.

3D printing also enables the rapid prototyping of medical devices, allowing manufacturers to quickly test designs for manufacturability and performance, narrowing the demand-supply gap. For example, life sciences company Fluicel uses Biopixlar high-res 3D printing technology to produce biocomposites that mimic the insulin-producing function of the pancreas, enabling the company to test a new product for treating Type 1 Diabetes accurately.