Beginning in 2019, the prevailing supply chain trends took a negative turn, as the pandemic and other global events created significant manufacturing disruptions. Pandemic lockdowns in countries like China and Vietnam, severe weather around the world, and geopolitical forces led to shortages in multiple industries. Luxury car manufacturers had to scramble for semiconductors, in competition with industries like medical device producers, who also had trouble obtaining medical-grade plastics. Even commercial printers had a hard time sourcing paper and ink.

But this year, the situation has improved. The pandemic is receding, businesses and governments are finding workaround solutions, and supply chain disruptions have eased. According to Freightos, as of September 2022, shipping rates had dropped 61% from a year earlier. On the inputs side, a push towards domestic production for certain crucial components—such as semiconductors—should help as well. This is good news.

But shortages of raw materials continue to be a problem, and that same Freightos analysis points out that shipping costs are still 170% above pre-pandemic levels. As Tony Lopez, Vice President of Manufacturing & Logistics Services for PRIDE Industries, says: “We’re not out of the woods yet. It’s going to be a while longer before we can comfortably return to just-in-time manufacturing, and I think we’ll need further restructuring to get there.”

Lopez is not the only manufacturing executive to voice this opinion. According to an August 2022 survey by the National Association of Manufacturing, 78.3% of manufacturing leaders expect supply chain disruptions to continue to be their primary business challenge well into 2023. This perspective is hardly surprising, given that multiple global forces continue to disrupt the supply chain. Here are seven key factors that manufacturing businesses will have to contend with in 2023.

“We’re not out of the woods yet. It’s going to be a while longer before we can comfortably return to just-in-time manufacturing, and I think we’ll need further restructuring to get there.”

—Tony Lopez, Vice President of Manufacturing & Logistics Services for PRIDE Industries

Worker Shortages and Rising Wages

American companies have long looked to Asia for affordable labor. But that supply chain trend began to shift long before 2019, and the pandemic has only accelerated this change. According to an analysis by Ernst & Young, wages in China jumped by 12.5% in 2020. That same year, U.S. wages increased by a relatively modest 3.9%. Chinese wage growth is expected to continue as more provinces raise their minimum wage and the yuan remains strong. These changes have made some analysts worry that China is pricing itself out of the supplier market. And China is not the only country to see significant wage growth—Vietnam and Taiwan are also raising wages. Last month, Taiwan raised its minimum wage by $865 per month.

In the U.S., a more significant supply change trend is the shortage of workers, particularly in transportation. The trucking industry in the U.S. is already short 80,000 drivers, and according to the American Trucking Association, that shortage will double by 2030. This growing lack of drivers is one reason why lead times for container shipments remain extended, even as port backlogs ease and truck availability improves.

The China Situation

China isn’t just getting more expensive, it’s also gaining a reputation as an unreliable supplier. The country’s “zero-covid” policy has led to unpredictable and extended factory shutdowns over the past two years. China is home to three of the world’s five largest ports, located in cities that are also manufacturing hubs. Of these, Shanghai is the most important, typically handling 40% of the country’s exports. When Shanghai was placed in lockdown for two months this past year, manufacturing was disrupted and shipping traffic at the port dropped by 20%.

The Chinese government is expected to adhere to its zero-covid policy at least through the first half of 2023, which will further disrupt the delivery of both raw materials and component parts. And this isn’t even the most serious issue concerning China.

Eventually, China will loosen its COVID protocols, but the tension between the U.S. and China shows no signs of abating. China continues to behave aggressively towards Taiwan, the world’s biggest supplier of semiconductor microchips—and a strategic U.S. ally. If China and Taiwan ever go to war, global supplies of chips and other goods—especially electronics—will suffer greatly.

War in Ukraine

While a war between China and Taiwan is only hypothetical, the conflict between Ukraine and Russia is devastatingly real. Russia invaded Ukraine in February, and since then both countries have seen their exports of raw materials drop, due both to economic sanctions and to the transportation disruptions of war. When two Ukrainian chemical companies had to shutter, the world saw its supply of neon—which is used in chipmaking lasers—drop by half. Supplies of palladium, cobalt, and nickel are also greatly impacted by the ongoing war.

The war in Ukraine has already lasted longer than many experts predicted, a fact that prompted Supply Management Magazine to advise its readers that “…in the long run they should…consider any opportunities to increase supply chain resilience by switching to more local supply partners.”

Climate Change

As climate hazards become more frequent and severe, the impact of weather on the supply chain increases. A recent McKinsey study found that the probability of a hurricane strong enough to disrupt semiconductor supply chains will increase by up to four times by 2040, and that the probability of extreme rainfall disrupting heavy rare earths production will increase by as much as three times by 2030. In other words, the odds of a manufacturing site being taken out by an extreme weather event is growing.

And of course, extreme weather affects the movement of goods, especially since 90% of goods traded internationally are shipped by sea. Hellenic Shipping News reports that in 2020, roughly 3,000 containers of goods were lost overboard due to rough weather. To avoid these types of loss—and reduce the risk to ship and crew—captains will opt to stay in port longer or take more circuitous routes, which contributes to transportation delays and higher shipping costs.

The Push for Sustainability

Even as the supply chain grows more precarious, consumers are demanding that companies find and source greener materials and component parts. Today, environmental organizations scrutinize a company’s entire supply chain, and report back to consumers, who increasingly prefer to buy from companies with sustainable business practices. More than ever, companies with environmentally friendly practices are viewed favorably by the market. And the halo effect of sustainable manufacturing isn’t limited to a company’s reputation. A recent study published in ScienceDirect found that consumers were willing to pay more for sustainably made products—not just because they want to support green manufacturing, but also because they perceive eco-friendly products as performing better than their traditionally manufactured counterparts. For these reasons, it’s important for companies that are greening their supply chain to capitalize on their investments through public relations and awareness campaigns.

New Legislation: Positive Supply Chain Trends

The disruptions of the past two years are leading legislators to take a closer look at current supply chain risks, and governments around the world are enacting new legislation designed to address these issues. In the U.S., the Ocean Shipping and Reform Act of 2022, which became law on June 16, aims to curb the worst behaviors of international shipping companies, which raised prices by an order of magnitude during the pandemic. The cost of shipping a forty-foot container, for example, rose from about $1,300 to more than $11,000. The new law is designed to eliminate these unfair charges and crack down on some of the international shipping practices that have negatively impacted American businesses, including the unreasonable denial of American exports.

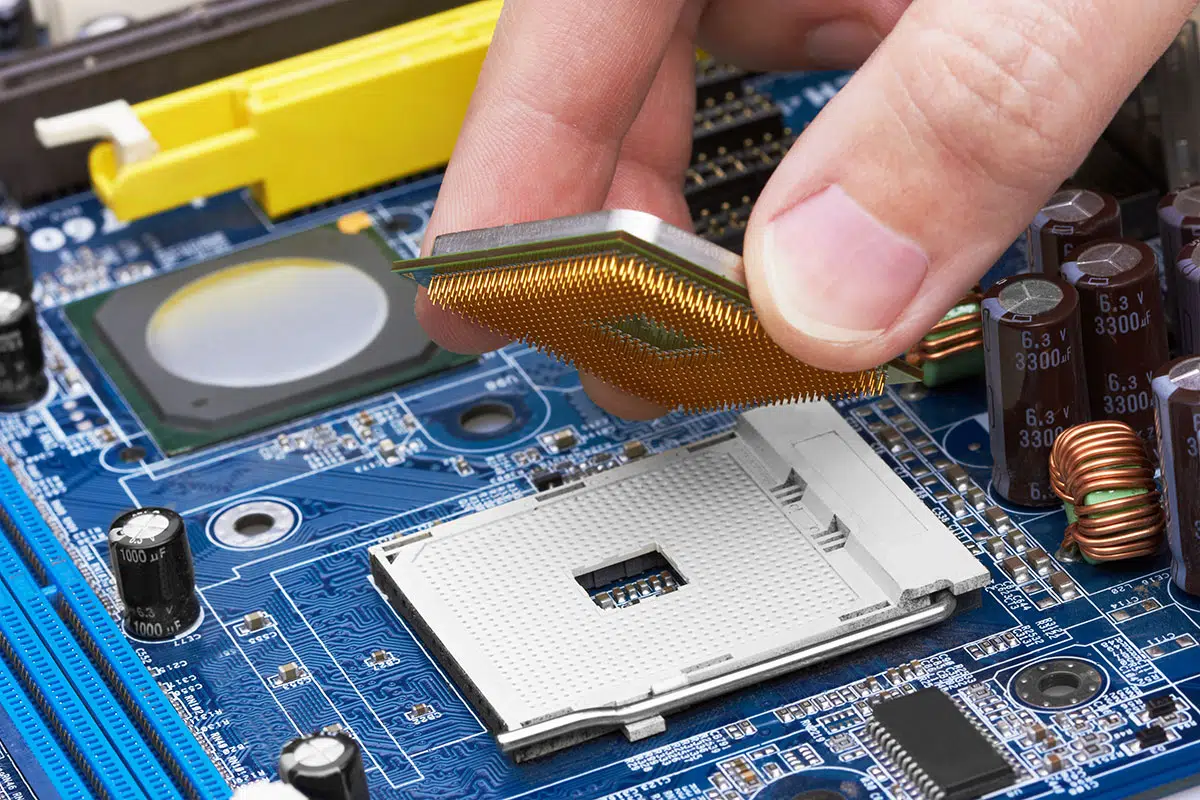

Another piece of legislation that should help ease supply bottlenecks is the CHIPS and Science Act, which was signed into law on August 9. In announcing the new law, the White House was blunt about its purpose: The new legislation is designed to “lower costs, create jobs, strengthen supply chains, and counter China.” On the heels of this new law, Micron and Qualcomm both announced a significant expansion of their chip-making capabilities. While American production of chips is still overshadowed by Taiwan’s output, increasing the domestic production of this critical component will bring more stability to multiple American industries.

The Latest Supply Chain Trends: Cyberthreats

The disruptions brought on by the pandemic accelerated multiple supply chain trends, including the growing closeness and interconnectivity of businesses and their suppliers. Companies now routinely link systems with their suppliers to facilitate communications and operations. But while linked systems are efficient, they have the drawback of expanding the “attack surface” for cybercriminals. These additional entry points can be exploited through aggressive hacking or by simple, old-fashioned phishing. To increase security, manufacturers not only have to ensure that their own systems are secure—they have to monitor their suppliers’ systems as well.

Our Prediction for 2023: Getting Better, But No Quick Return to Normal

A review of current supply chain trends shows generally positive developments. Supply bottlenecks are easing, and shipping costs continue to drop. Along with increased domestic production of critical components, these supply chain trends bode well for U.S. manufacturers. But a return to pre-pandemic normalcy remains elusive, primarily because of global politics. The war in Ukraine continues to disrupt global supplies of raw materials, and tension between the U.S. and China threatens the supplier relationships of many businesses. So while the supply chain is slowly improving, it’s a precarious recovery, and American businesses would be wise to diversify their supplier options.

A Manufacturing Partner You Can Rely On