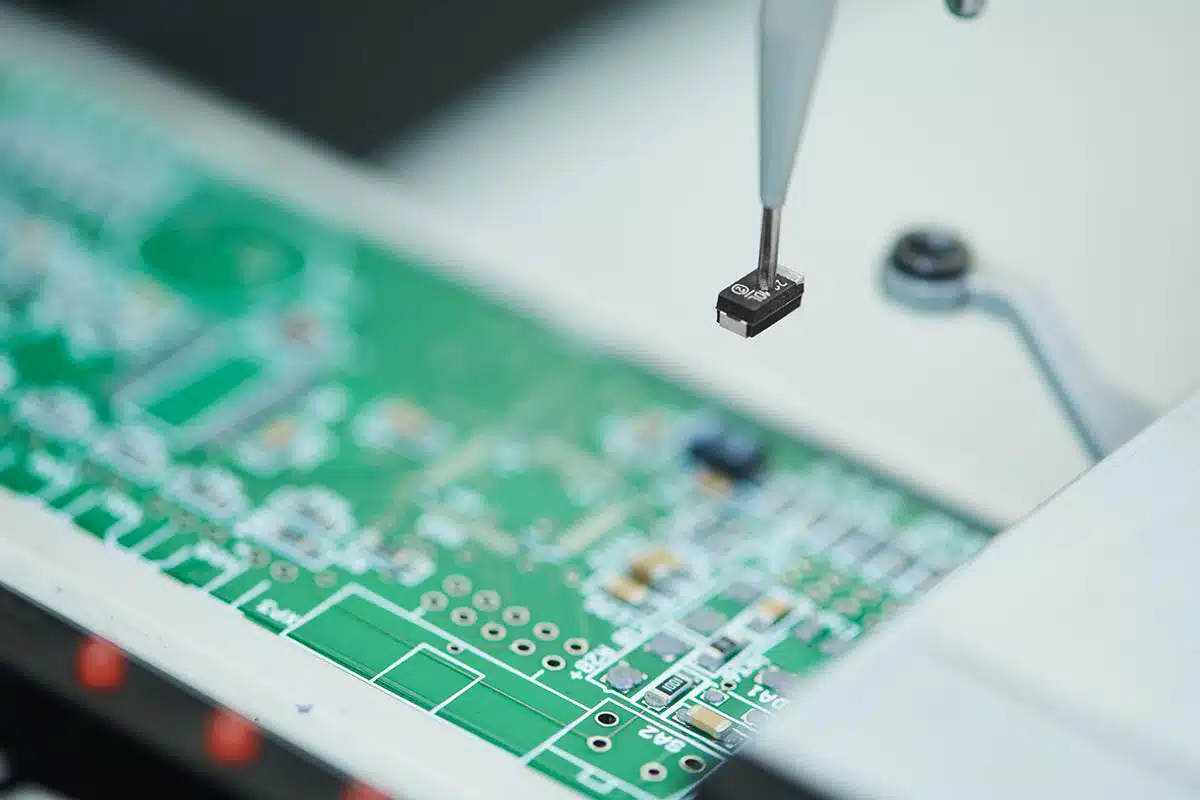

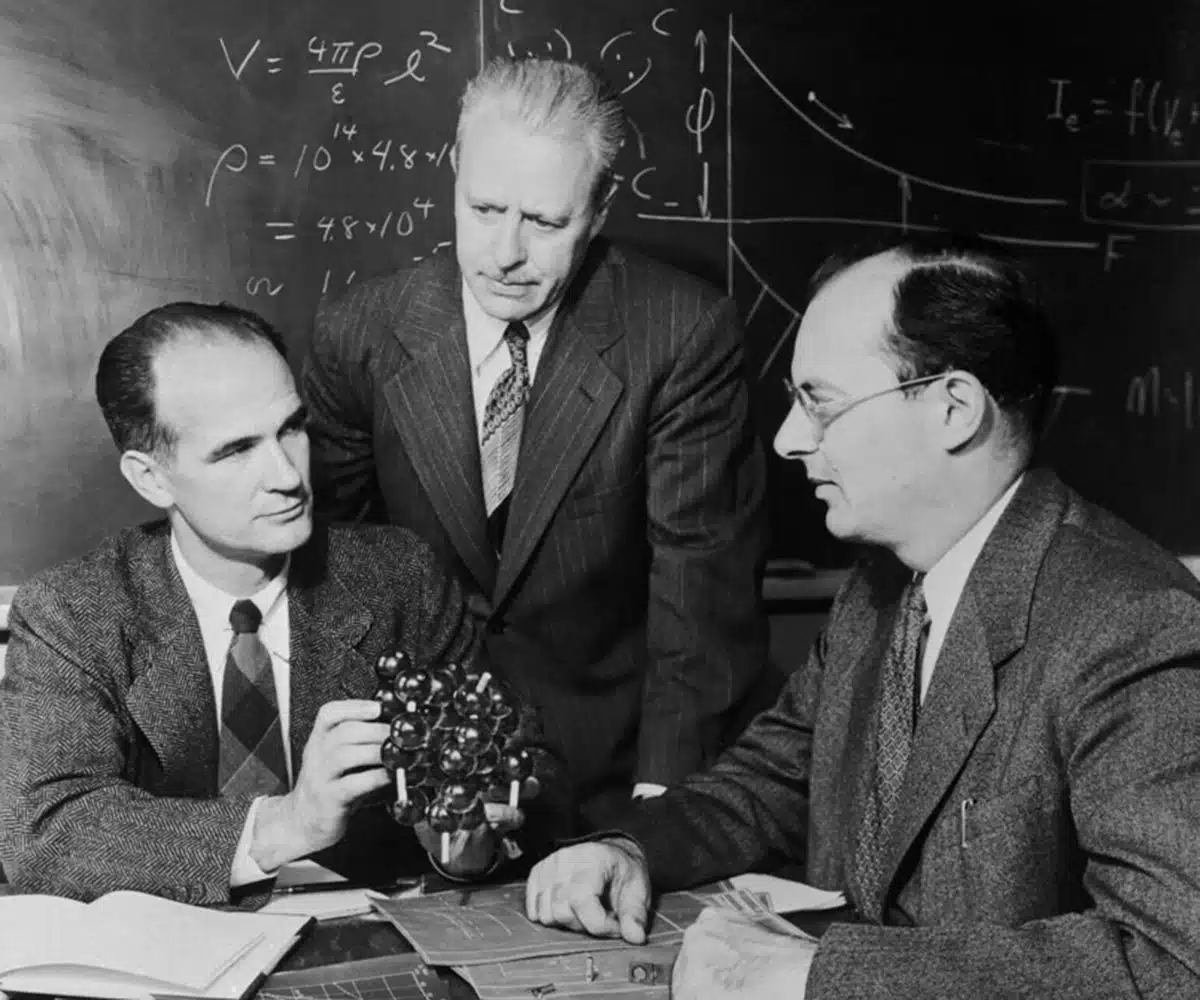

Did you know that semiconductor manufacturing got its start in 1874? That’s the year a young physicist named Karl Ferdinand Braun touched a thin metal wire to a galena crystal, creating an electrical current that flowed in only one direction. He’d discovered the rectifier effect. But it wasn’t until 1947 that John Bardeen and Walter Brattain at Bell Laboratories invented the point-contact transistor. A year later, William Shockley developed the junction transistor. The work of these three American physicists was so significant that in 1956 they were jointly awarded the Nobel Prize. By then the semiconductor industry was growing rapidly, and with the invention of the integrated circuit in 1959, semiconductor manufacturing entered the modern era.

Since the late fifties, the demand for semiconductors has grown steadily, though the supply chain has experienced occasional hiccups, especially in recent years.

The Pandemic’s Effect on Semiconductor Manufacturing

The semiconductor supply chain was fragile even before the pandemic. The trade wars between the U.S. and China (beginning 2018) and Japan and Korea (beginning 2019) set the stage for what would be several years of supply chain turbulence in semiconductor manufacturing. The chip shortage escalated in the following years, fueled by natural disasters and weather disturbances at home and abroad, in addition to multiple semiconductor plant fires in Japan.

Then the pandemic hit.

Today it’s generally believed that the automotive industry was the sector that suffered most from pandemic-caused chip shortages. Less well known is the fact that—initially—the pandemic actually created a glut of chips destined for cars. That’s because, as lockdowns became common, workers holed up in home offices and let their cars idle. This decreased need for transportation, and the subsequent car manufacturing plant closures, led to decreased demand for semiconductors in the automotive industry.

At the same time, the rise in remote workers, at-home students, and other individuals stuck at home led to increased demand for notebooks, tablets, and entertainment devices like smart TVs and game consoles. Likewise, telecommunications providers and hyperscalers—large cloud service providers such as Amazon, Microsoft, and Google—needed more chips to keep up with the public’s increased demand for online work and entertainment. Fortunately, because of the downturn in the car industry, electronics companies were mostly able to get the semiconductors they needed by turning to the supply of “leftover” chips from the auto industry.

According to McKinsey & Company, 37 percent of the world’s semiconductors were manufactured in the United States in 1990. Three decades later, only 12 percent are. The result is that U.S. companies are now highly dependent on chips made abroad.

Eventually, however, lockdowns ended and the demand for cars took off. At that point, carmakers began buying all the chips they could get their hands on. Electronics manufacturers now had to compete with the auto industry for these essential components.

Chip Shortages Affect Electronics Manufacturers

The semiconductor shortage was further complicated by innovation. Even during difficult times, electronics manufacturers continued to develop new technologies, many of which relied on even more chips than their predecessors. Added to this increased need were several global factors. Geopolitical tensions spurred some countries to stockpile semiconductors. And extreme weather events negatively impacted the chip supply.

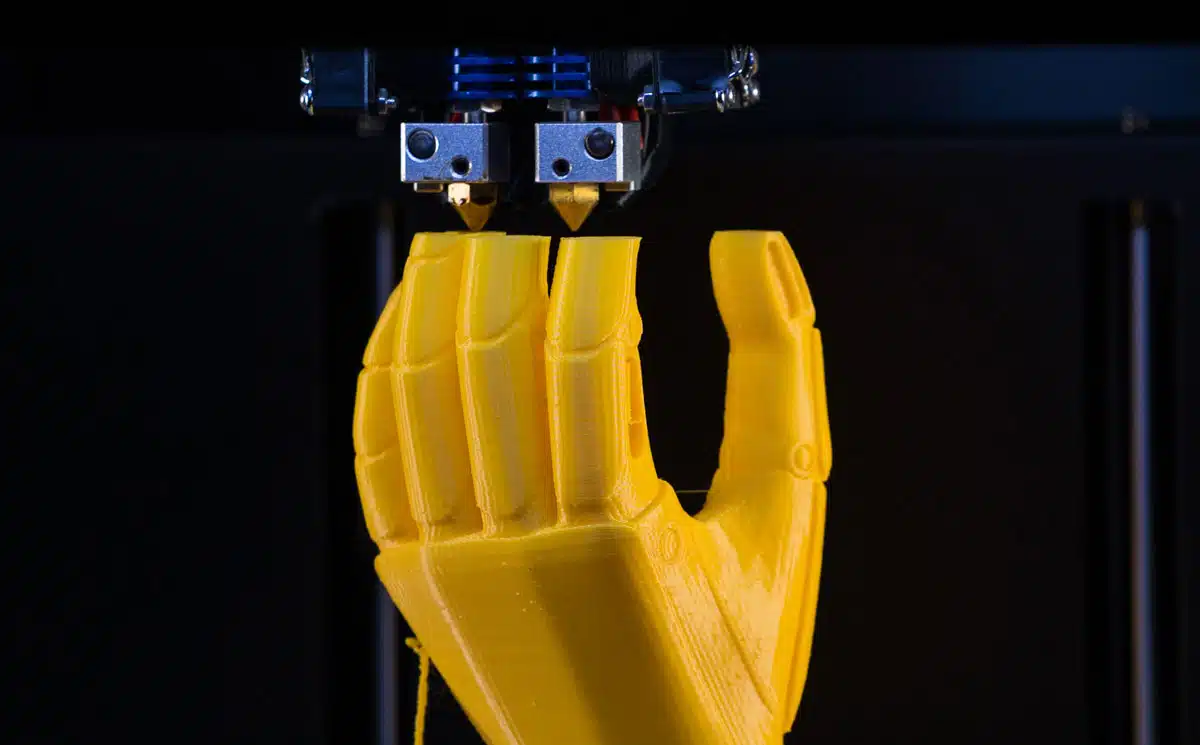

This global chip shortage affected manufacturers of all kinds of goods, from light switches, cell phones, and appliances, to medical devices and military equipment. Semiconductor manufacturing was experiencing unprecedented demand, just as hoarding and supply disruptions were growing. Prices rose accordingly.

And at this point, Congress stepped in.

The Creating Helpful Incentives to Produce Semiconductors and Science Act (CHIPS Act)

According to McKinsey & Company, 37 percent of the world’s semiconductors were manufactured in the United States in 1990. Three decades later, only 12 percent are. The result is that U.S. companies are now highly dependent on chips made abroad. While the U.S. semiconductor industry still maintains high market share in sectors that are R&D intensive (electronic design automation and core intellectual property), activities that are more capital intensive (wafer fabrication and assembly, testing, and packaging) are largely concentrated in Asia.

Recognizing the importance of a stable domestic supply of semiconductors, in 2020 a bipartisan group of lawmakers introduced the CHIPS Act. Passed in July 2022, the goal of the CHIPS Act is to encourage companies to bring manufacturing back home to the United States.

Goals of the CHIPS Act

The CHIPS Act is a $280 billion spending package passed by Congress to support domestic semiconductor manufacturing. It also authorizes federal science agencies to pursue policies that encourage domestic production. Approximately $50 billion of the spending is earmarked for direct investments in semiconductor manufacturing. The rest will be used for R&D, engineering and math programs, workforce development, and tax credits to spur private investments.

The CHIPS Act has three main objectives: stabilizing the domestic supply chain of chips, boosting American economic competitiveness, and protecting semiconductors from sabotage during the manufacturing process.

Stabilizing the Semiconductor Supply Chain

A manufacturer may have a reliable workforce, sufficient capital, and a well-constructed business plan. Yet without the essential components to manufacture products, business as usual will come to a grinding halt. Too many industries in the past several years experienced this scenario firsthand. By bringing semiconductor manufacturing back to U.S. shores, many uncontrollable supply chain variables—such as international politics and the effects of overseas natural disasters—can be eliminated.

Boosting America’s Ability to Compete

The CHIPS Act includes financial incentives designed to entice American firms to increase their share of global semiconductor manufacturing. The Carnegie Endowment for International Peace predicts that these incentives will spur U.S. manufacturers to grow their capacity significantly. New funding may even encourage innovation in downstream industries such as advanced wireless devices and artificial intelligence.

New research and development initiatives are especially important for the industry, as Moore’s Law—which states that the number of transistors on a chip will double every 24 months—is slowing. Cramming more and more transistors into the same space is becoming increasingly difficult, and therefore more expensive. With the cost of fabrication rising and the number of firms with advanced technical expertise shrinking, the semiconductor sector is at risk of stalling out. This is the scenario that the CHIPS Act aims to avert.

While the CHIPS Act focuses on technology, a welcome companion to America’s bid to become more competitive is the increase of jobs on American soil. The Department of Commerce estimates that the semiconductor industry will need an additional 90,000 workers by 2025.

Reducing the Risk of Sabotage

Semiconductors are at risk for sabotage at several stages of production. For example, a hostile actor could alter manufacturing recipes or manipulate the sensors used for performance testing. After the manufacturing stage, security risks continue as chips are transported globally.

With the most reputable manufacturers—such as Intel, Taiwan Semiconductor Manufacturing Company (TSMC), and Qualcomm—the risk of sabotage is lower. These manufacturers have the resources to invest in security and a reputation to maintain with customers. The risk increases, however, with less reputable companies, especially those who are beholden to national governments overseas. These companies may willingly, or through coercion, partner with a government or private entity to commit sabotage.

By bringing semiconductor manufacturing back home—all facilities funded through the CHIPS Act must be located in the United States—it’s hoped that plants and products will be less vulnerable to sabotage. The assumption is that sabotage on a facility-wide scale will be harder to conduct under the watchful eye of U.S. counterintelligence officers and under U.S. laws, which give federal agents the power to investigate irregularities. Of course, every facility, no matter its location, remains vulnerable to remote cyberattacks and traditional espionage. But siting plants on domestic soil should reduce these risks considerably.

What is the Future of Semiconductor Manufacturing?

According to International Data Corporation (IDC), the semiconductor market declined slightly in 2023 as demand continued to stabilize. In 2024, the market is expected to fully recover, and IDC predicts an annual growth rate of 20 percent. Some of this growth will be due to the demand for more AI integration with personal devices, such as smartphones, PCs, and wearable devices.

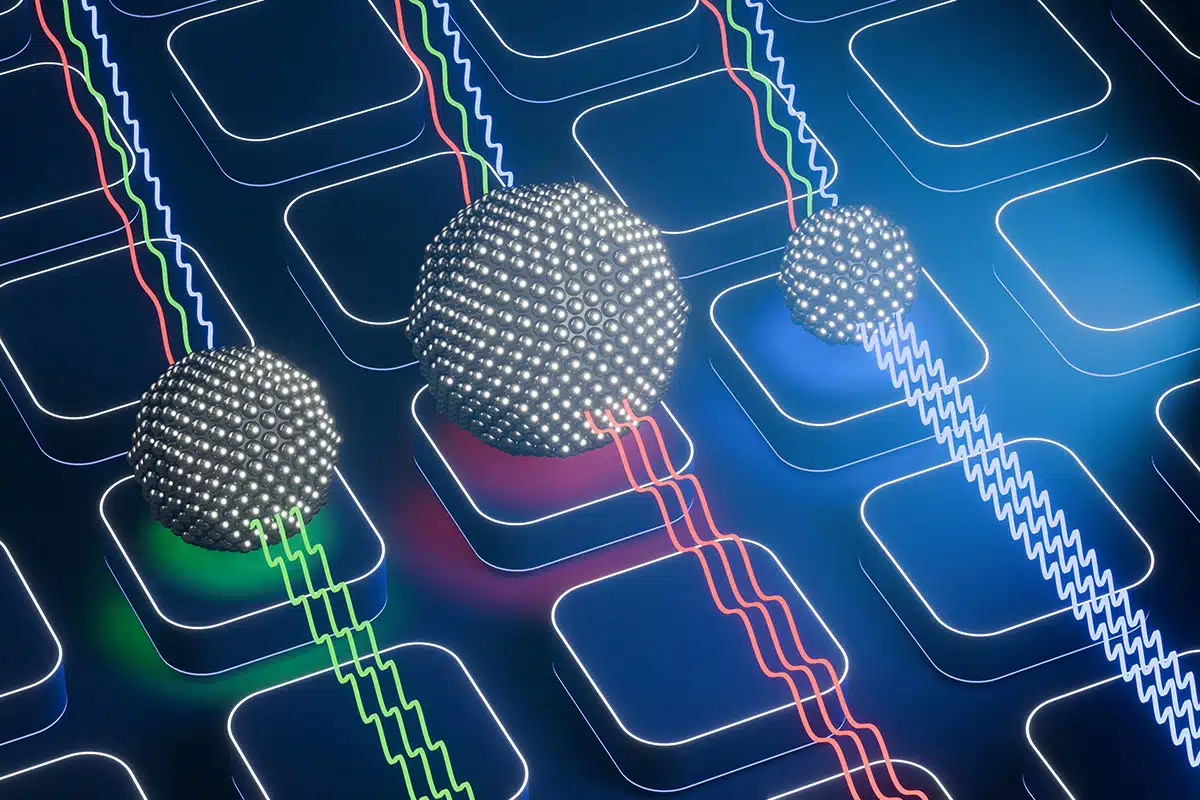

AI integration and other demand factors aren’t just pushing manufacturers to increase production; these factors are also driving innovation in chip technology. As mentioned, it’s becoming increasingly difficult to improve transistor-based technology by packing more transistors into a tighter space. So now researchers are exploring an alternative approach: replacing conventional transistors with quantum-dot cellular automata (QCA), a new technology that relies on mixed-valence molecules.

What are the advantages of QCA? According to a study published in the Journal of Computational Chemistry, QCA provides “a low-power computing paradigm that may offer ultra-high device densities and THz [terahertz]-speed switching at room temperature.” While current traditional gigahertz technology processes at billions of cycles per second, terahertz technology is capable of trillions of cycles per second—1,000 times faster.

Emerging technology and consumers’ ever-growing demand for electronics will likely continue to fuel the rise in demand for semiconductors, making it more important than ever to ensure the supply chain is stable. Fortunately, with the support of the CHIPS Act, the outlook for a steady and reliable domestic supply is favorable. That’s good news for electronics manufacturers, who are now better positioned to keep their products in stock and competitively priced.